What is PAN card: Steps to apply for PAN card and its types

What is PAN card: Steps to apply for PAN card and its types!

Pan Card has now become essential for everyone. PAN card i.e. 10-character permanent account number issued by the Income Tax Department. It is also useful for economic work as an ID card. You need a PAN card for many things, even now you need a PAN card to open a bank account. In almost every field you need a PAN card. Today we will tell you what is PAN card: steps to apply for PAN card and its types and other important information related to PAN card. Stay connected with us till the end of the article to get all the information:

What

is a PAN card?

PAN card ( Permanent Account Number ) is a document that is

used for work like paying taxes, opening an account, investing. This card

contains information related to the cardholder. It is a unique identification

number important for any type of financial transaction.

There are 10 alphanumeric numbers on the PAN card which are

issued through the Income Tax Department. The PAN card is made in the form of a

laminated card under the Income Tax Act, 1961. It is issued by the Income Tax

Department under supervision of the Central Board of Direct Taxes (CBDT).

Who can apply for a PAN card?

Anyone, PAN card is made not only for individuals, but also

for a company, a partner company. It is very important to have a PAN card for

institutions that are income tax payers.

Subscribe our WhatsApp channel Click to join

Which Document required for PAN card application

👉Documents for Individual Applicant

• ID proof

(any one)

• Aadhar

card

• Voter ID

• driving

license

• Ration

card

• Pensioner

Card having photograph of the applicant

• bank

certificate

• Document

for residential address (any one)

• Basic

address proof

• Aadhar

card

• Voter ID

• electricity

bill, water bill

• postpaid

mobile phone bill

• bank

passbook

• gas

connection book

• driving

license

• certificate

for date of birth

• Aadhar

card

• Voter ID

• Passport

• 10th mark

sheet

• domicile

certificate

• In case of

minor (documents of parent or guardian)

• email id

• passport

size photo

• bank

account number

👉Documents for Hindu Undivided Family (HUF)

• An affidavit issued by the Hindu Undivided Family Card

giving the names, addresses and father's names of all accomplices as on the

date of application.

• Identity proof, address and date of birth in case of

unitary Hindu undivided family

👉For a company registered in India

• Photocopy of the company registration certificate issued

by the commercial register

For a trust created or registered in India

• Copy of the registration number certificate issued by the

Charity Commissioner or copies of trust documents

👉For companies and registered partnership

companies established in India

• A photocopy of the Registration Certificate issued by the

Registrar of the company or limited liability company

• Photocopy of the partnership agreement

👉Not being an Indian citizen(NRI)

• Identity

proof (any one)

• Passport

• PIO Card

• OCI Card

• citizenship

identification number

• Address

proof (any one)

• PIO Card

• OCI Card

• TIN

• Bank

statement

• Other

Nationality or Citizenship ID Card

• NRI Bank

Account Passbook

• copy of

residential permit

• Registration

Certificate issued by FRO

• Visa and

Appointment Letter

Steps to how to apply for a PAN card?

You can apply for a PAN card in two ways. Here we will tell

you about online and offline media.

Steps to Online application process for PAN card

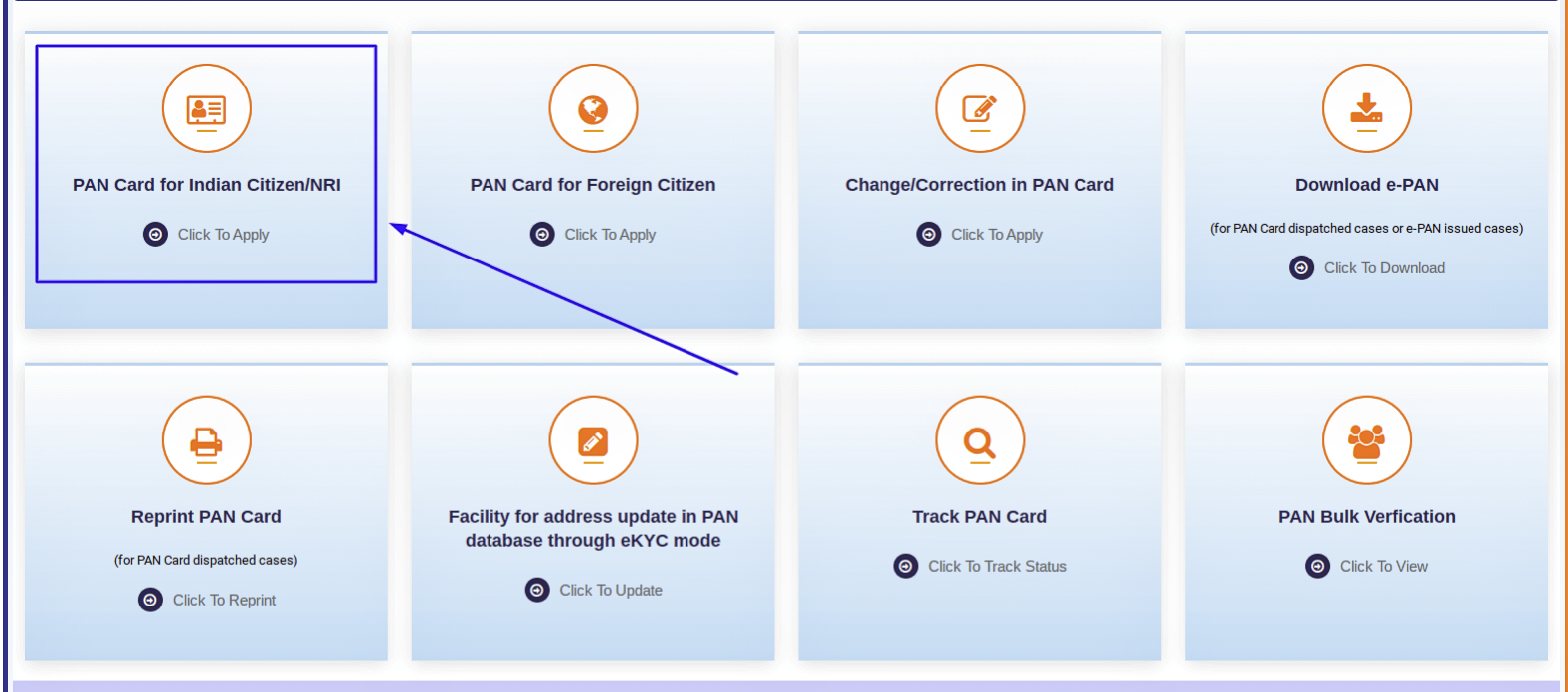

• To apply for PAN card you need to visit the official

website of UTIITSL.

•You need to go to the PAN Card Services option on the home

page of the website.

• Now you have to select Apply PAN Card.

• Now all category options will appear in front of you,

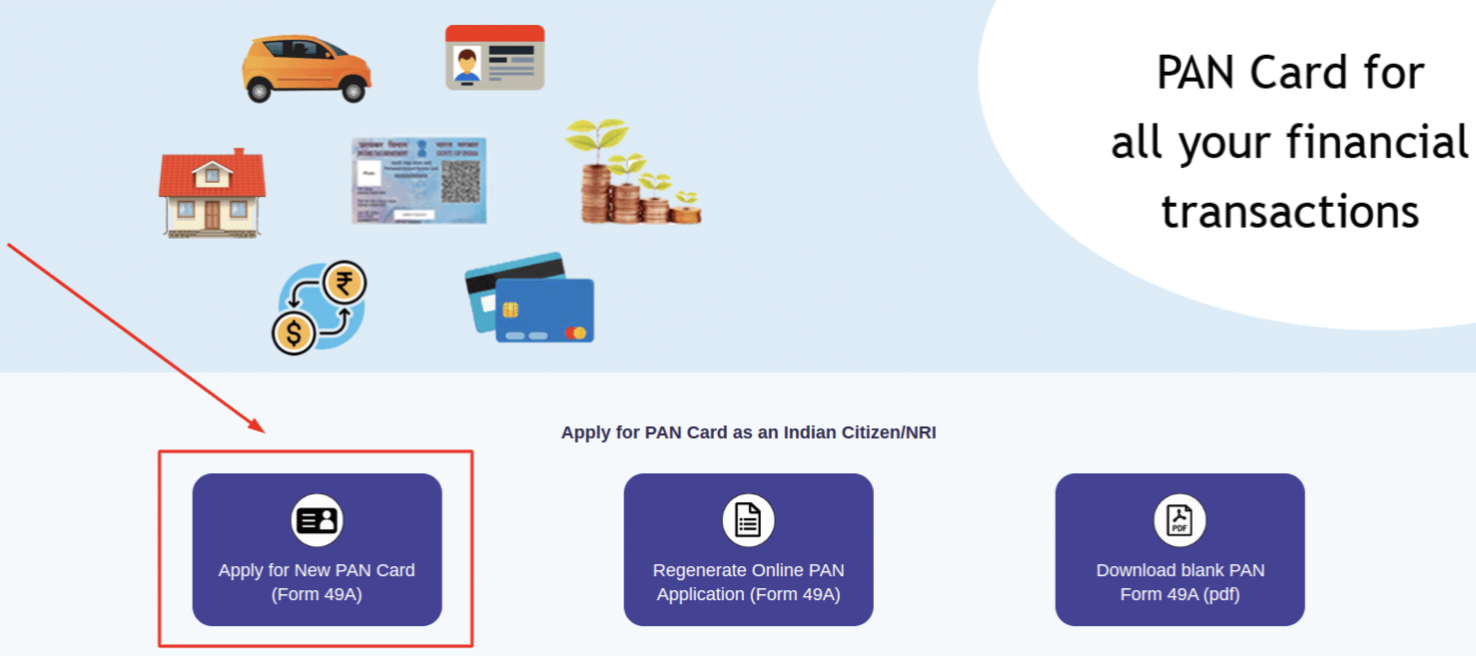

after that you have to select PAN Card For Indian Citizen / NRI.

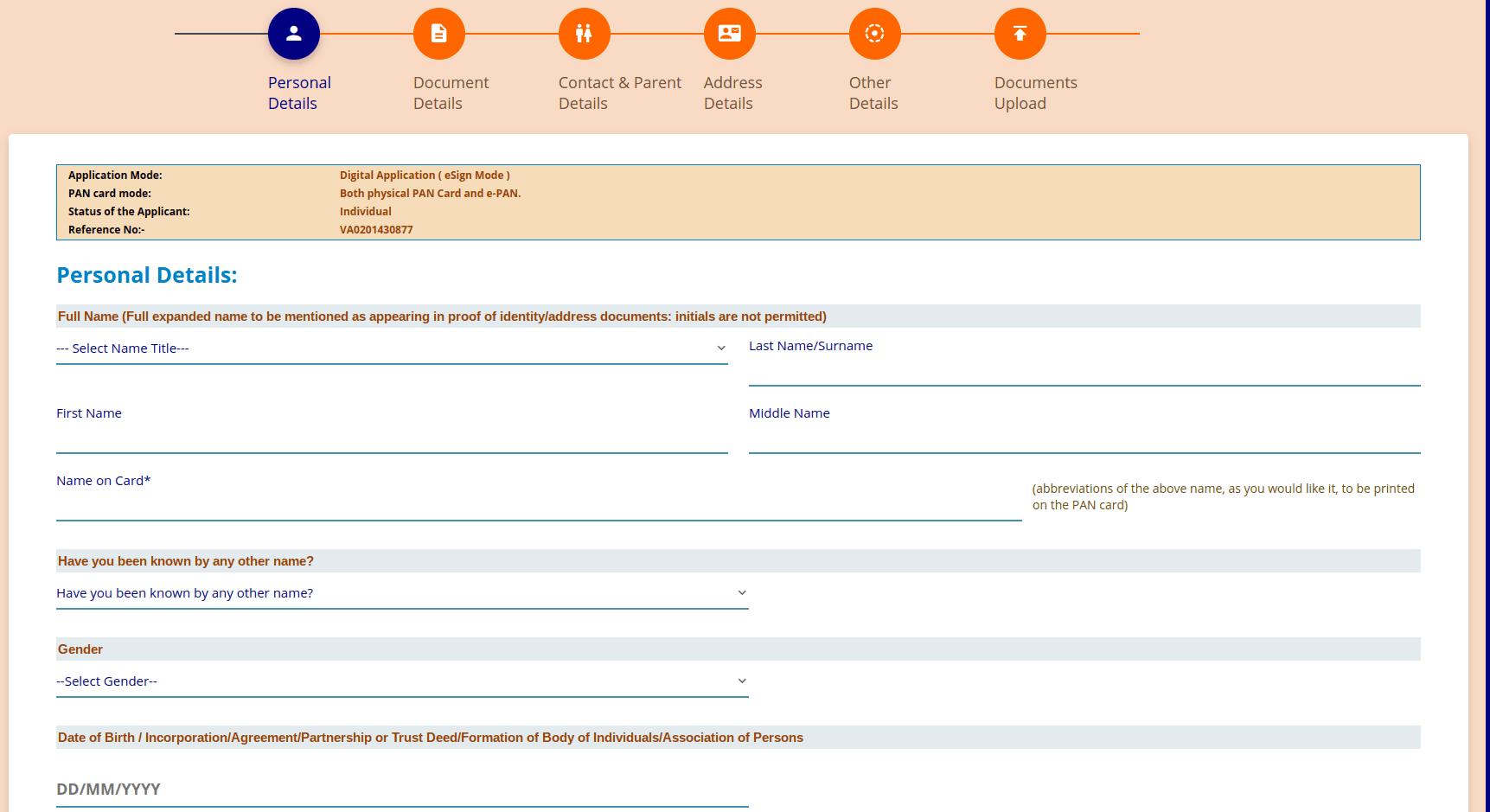

• Now another page will open in front of you where you have to select Apply For New PAN Card (Form 49A).

• Now a form will open in front of you. Here you have to

choose a mode.

• Select Application Status. If you are making for yourself,

select Custom.

• Click submit.

• Now you get the reference number, copy it down or write it

down in a safe place.

• Now here you have to fill all the required information

carefully and click on Next step.

• Now you need to fill the address, if you are applying through e sign mode then you will not need to fill the address.

• Now you have to fill all the information like this.

• After uploading all documents, click Submit.

• Then the application confirmation will open in front of

you. You must write down the application number here.

• Now click on Make Payment.

• Now you have to pay.

• After successful payment

• One time password will be sent to your registered mobile

number. Fill it up

• After filling the OTP click Submit.

• Fill in all the required information on the next page.

• Now click on Update.

• Enter your Aadhaar number.

• Click to Get OTP and Now fill the OTP which will come on

your Aadhaar registered mobile number.

• This will complete your application, print it.

• The application number mentioned in it will help you to

check the status of your PAN card.

Subscribe our WhatsApp channel Click to join

Usage of PAN Card

• Pay Tax: Individuals and companies must have a PAN

number to pay tax. If a person or organization does not have a PAN card, they

will have to pay 30% of their income as tax, irrespective of which tax bracket

they fall in, so PAN is mandatory to pay tax.

• Business Registration: Companies, Partnership

Firms, Hindu Undivided Families or other entities require a PAN number to

register their businesses.

• To open a bank account: Now KYC has become

necessary to open a bank account for which you need to have a PAN card.

• Financial Transactions: Any person or company can

do financial transactions only if they have a PAN card.

• For public network connection: PAN card is also used

for facilities like paid mobile connection, LPG connection, electricity

connection, internet connection etc.

Pan card structure

• The PAN card contains the name of the PAN holder. The

individual's PAN card bears his name, the company's PAN card bears the

company's name, the partner firm's PAN card bears his name.

• If the card is a person's PAN, then the name of the

person's father is on it.

• A person's date of birth is also recorded in his PAN card.

The date of their registration is entered in the company and the partner

company.

• The most important information on the PAN card is the PAN

number. Every person or company has a different PAN number. This number is

generated based on the data provided by the cardholder. This 10 is

alphanumeric. Each letter carries some information. Which are as follows:-

• The first three letters are in the alphabetical range A to

Z.

• The fourth character of the PAN number indicates the

taxpayer's category. Which are as follows:-

• A – Association of persons

• B – BOI (body of an individual)

• C – Company

• F – Company

• G – Government

• H – Hindu Undivided Family

• L – Local authority

• J – Artificial judicial person

• P – Personal

• T – Association of persons for trust

• The fifth letter is the first letter of the person's last

name.

• The remaining 5 letters are random.

• The last letter of the PAN card is the alphabet.

• The last data on the PAN card is in the form of a person's

signature.

• The PAN card also contains a photo of the cardholder,

which serves as proof of identity of a natural person. In companies and firms,

there is no photo on the PAN card.

Offline application process

• You can download the form from NSDL or UTIITSL website.

• Or you can also download PAN Card Application Form 49A PDF

or PAN Card Application Form 49AA PDF from here.

• Fill out the entire form carefully. Insert two color passport size photos in it.

• Include your signature on the photo.

• You must fill in the form with a black pen.

• Aadhar card will be required to generate PAN card.

• Attach all necessary documents to the form.

• You will have to submit both the form and the fee to the

PAN card office.

• Then your PAN card will be sent by post to your given address.

PAN Card Types:

PAN card is available for individuals and companies. Therefore,

PAN card applications are created in different forms. Below are the types of

PAN cards and their applications:-

• pan card for individuals

The most common type of PAN card is issued to individuals.

For this you can apply on NSDL or UTIITSL official website. For this you need

to fill Form 49A. Any eligible Indian individual or minor and student can apply

for it.

• PAN card for NRIs or persons of Indian origin

NRIs and PIOs can use PAN card for taxation purposes in

India. They also need to submit Form 49A to avail this card.

• PAN card for foreign entities paying taxes in India

Firms or corporations that are registered outside India but

pay taxes in India based on their business operations in India. These

organizations can also avail PAN card. To apply for PAN card they have to fill

form 49AA.

• PAN card for OCI and NRE

Overseas Citizen of India (OCI) and Non-Resident Entities

(NRE) can also apply for PAN card. They should fill Form 49AA while applying

for PAN card.

• Pan card for Indian companies

Corporate companies registered and operating in India can

also use the PAN card for their financial and tax transactions.

Frequently asked questions

•What is

the full name of PAN card?

The full name of PAN card is Permanent Account Number.

•Who issues

the PAN card?

The PAN card is issued by the Income Tax Department.

•Why PAN

card is needed?

If you have PAN card you can pay income tax easily, for

transactions above 50000 you need to have PAN card.

•How to

change pan card photo?

You have to fill PAN card correction form to change the

photo.

Subscribe our WhatsApp channel Click to join

Post a Comment