Atal pension yojana | Atal

pension yojana chart | Atal pension yojana calculator | Atal pension yojana

benefits | Atal pension yojana scheme | Atal pension yojana statement

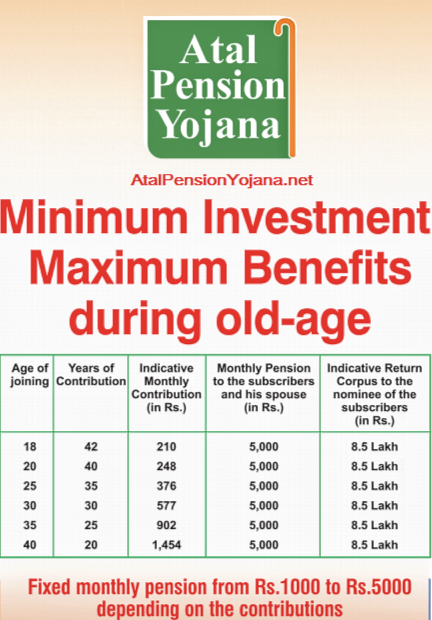

👉Atal Pension Yojana (APY) is an old age income security scheme for all savings account holders in the age group of 18-40 years. Under APY, subscribers would get a fixed minimum pension of Rs. 1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000 per month at the age of 60 depending on their contributions which would be based on the age of joining APY. The minimum age to join APY is 18 years and the maximum age is 40 years. Therefore, the minimum period of contribution by any APY subscriber would be 20 years or more.

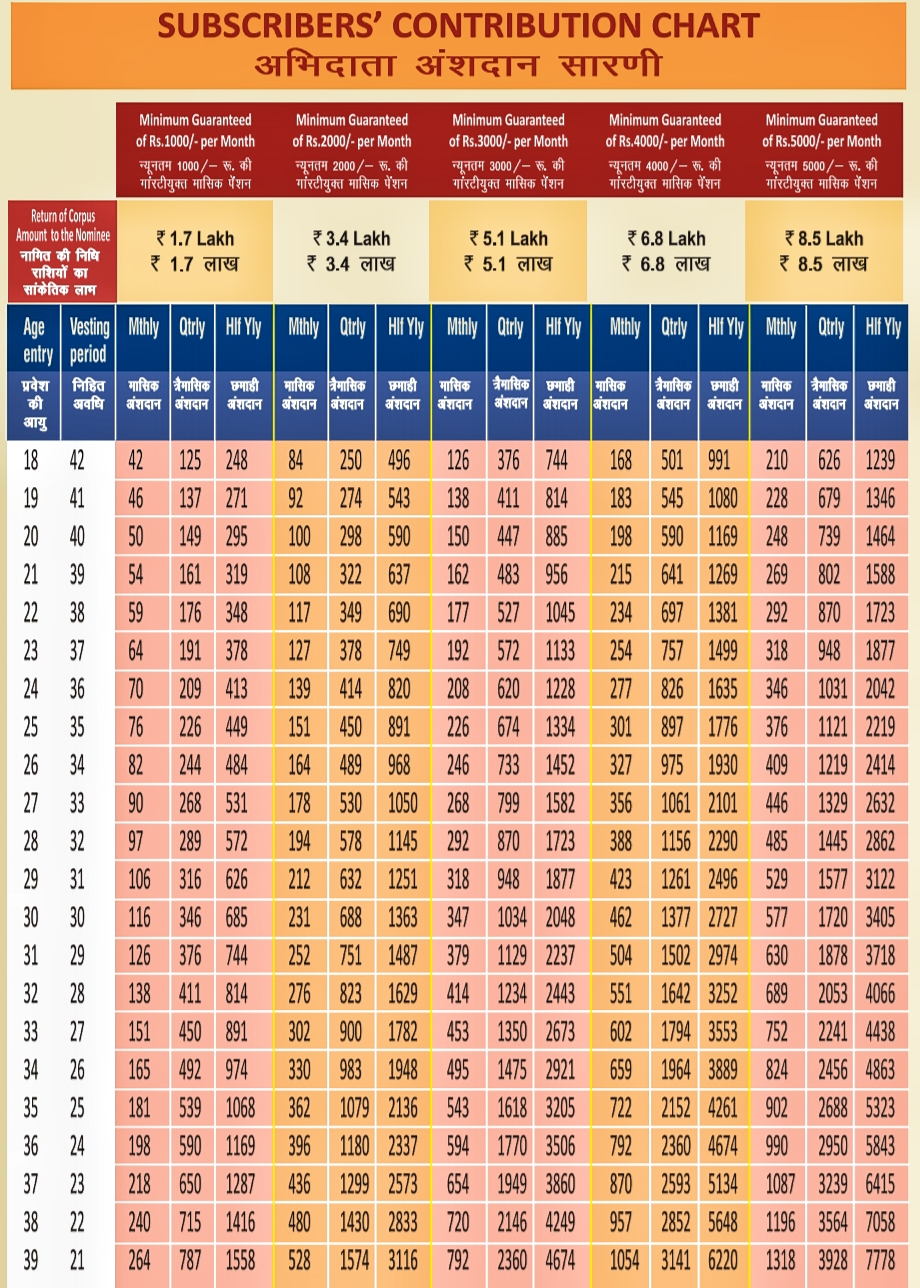

👉APY Subscriber Contribution Table:

👉Penalty for non-compliance:

Under APY, individual subscribers have

the option to contribute on a monthly basis. Banks will levy an additional

amount for late payments, this amount will vary from the minimum of Rs. 1 per

month to Rs.10/- per month as given below:

• Rs. 1 per month for contribution up

to Rs. 100 per month.

• Rs. 2 per month for contribution up

to Rs. 101 to 500/month.

• Rs. 5 per month for contribution

between Rs 501 to Rs 1000 per month.

• Rs. 10 per month for contribution

above Rs.1001/- per month.

The fixed amount of interest/penalty

will remain as part of the pension corpus of the participant.

👉Suspension of payments of the contribution amount will

lead to the following:

• After 6 months the account will be

frozen.

• After 12 months, the account will be

deactivated.

• After 24 months, the account will be

closed.

Subscribe our WhatsApp channel Click to join

👉Raising Grievance Under APY:

Subscriber can anytime raise grievance free

of cost and from anywhere by visiting: www.npscra.nsdl.co.in >>Home >> select: NPS-Lite or through CGMS

👉Helpline Number:

Toll Free Helpline number for APY Scheme is

1800-110-069

👉Eligibility:

•Starting age and

contribution period: The minimum age to join APY is 18 years and the maximum age

is 40 years. The retirement age would be 60 years. Therefore, the subscriber's

minimum APY contribution period would be 20 years or more.

•All bank account holders under eligible category can join APY with automatic debit to accounts.

👉Exclusion:

Taxpayers will not be able to join APY from 1 October 2022. If

a plan subscriber who enrolled on or after October 1, 2022 is later found to

have paid income taxes on or before the application date, the APY account will

be terminated and the member will be awarded the total amount of pension assets

accumulated up to that point in accordance with the order. Members of the

statutory social security scheme are not eligible under this scheme.

Atal pension yojana | Atal pension yojana chart | Atal pension yojana calculator | Atal pension yojana benefits | Atal pension yojana scheme | Atal pension yojana statement

👉Statutory social

security system

• The Employees Provident Fund and Miscellaneous Provident

Act, 1952.

• Coal Mines Provident Fund and Miscellaneous Provision Act,

1948.

• Assam Tea Plantation Provident Fund and Miscellaneous Provision,

1955.

• Seamens’ Provident Fund Act, 1966.

• The Jammu Kashmir Employees' Provident Fund and

Miscellaneous Provisions Act, 1961.

• Any other statutory social security scheme.

👉Application Process:

Procedure 1

1. You can also open an APY account online using your bank's

Net banking facility.

2. The applicant can log into their online banking account

and search for APY on the dashboard.

3. The customer must fill in some basic and nominated data.

4. The customer must agree to the automatic deduction of the

premium from the account and submit the form.

Procedure 2

1.Visit website “https://enps.nsdl.com/eNPS/NationalPensionSystem.html “ and select “Atal Pension Yojana”.

2.Select “APY Registration”

3.Fill the basic details in the form. One can

complete KYC through 3 options:

• Offline KYC: where

Aadhaar XML file needs to be uploaded

• Aadhaar: where KYC is

done through OTP verification in mobile number registry with Aadhaar

• Virtual ID: where a

virtual Aadhaar ID is created for KYC.

👉Required document:

1. Aadhaar Card

2. Details of active

bank/postal savings account

Subscribe our WhatsApp channel Click to join

👉Frequently asked questions: Atal

Pension Yojana

• When will I

receive my pension❓

The retirement age

would be 60 years

•I am a Swavalamban

subscriber. Can I still apply for APY❓

All registered

Swavalamban subscribers aged 18-40 will be automatically migrated to APY

•What happens if the

post is late❓

Subscriber will be

charged delinquent interest for the overdue period if the APY contribution is

delayed beyond the due date

•How do I know the

status of my contribution❓

Periodic subscriber

information regarding PRAN activation, account balance, contribution credits

etc. will be sent to APY subscribers through SMS alert on registered mobile

number or can be accessed through Mobile/APY application launched by NSDL. The

subscriber will also receive a physical account statement once per financial

year to their registered address.

•Can an employee of

Central/State Government or Public Sector Undertaking and/or NPS subscriber

subscribe to APY❓

YES, any Indian citizen

in the age group of 18 - 40 years can join the APY scheme irrespective of

his/her government/public sector employment status to avail the benefits

guaranteed by the Government of India under this scheme. An existing NPS

subscriber can also subscribe to APY if they meet the basic eligibility

criteria for availing the benefits guaranteed by the Government of India;

according to the scheme

•Can I open an APY

account without a savings bank account❓

No, Savings Bank

Account / Post Office Savings Bank Account is mandatory to join APY.

•If I have completed 40

years, can I join Atal Pension Yojana❓

No, currently a person

who is in the age group of 18 years to 39 years 364 days can join Atal Pension

Yojana.

👉Also Check: Ladli Laxmi yojana